Publicly traded corporations are required by law to prepare financial statements both quarterly and annually. On the other hand, a multi-step income statement follows a three-step process to calculate the net income, and it segregates operating incomes and expenses from the non-operating incomes. It separates revenues and expenses from activities that are directly related to the business operations from activities that are not directly tied to the operations. A multi-step income statement is ideal for large, complex businesses that use a long list of incomes and expenses. A single-step income statement focuses on reporting the net income of the business using a single calculation.

When calculating operating expenses, don’t include any expenses already included in the cost of goods sold, such as direct labor and materials purchased. If you’re creating a multi-step income statement for the first quarter of 2020, your trial balance should be prepared for the same quarter. However, if your business is in a growth stage, or you’re looking to obtain a bank loan or attract investors, a multi-step income statement provides details that are missing from the single-step income statement.

What Is a Single-Step Income Statement?

Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In a recent Oregon visit, U.S. agricultural secretary touts Biden’s climate agenda as a boost for rural America – Oregon Public Broadcasting

In a recent Oregon visit, U.S. agricultural secretary touts Biden’s climate agenda as a boost for rural America.

Posted: Tue, 01 Aug 2023 17:53:58 GMT [source]

Nonoperating revenues and expenses appear at the bottom of the income statement because they are less significant in assessing the profitability of the business. The multi-step income statement details the gains or losses of a business, in a specific reporting period. Its format separates a company’s operating revenue and operating expenses from its non-operating revenue and non-operating expenses.

Single-Step vs. Multi-Step Income Statement

Start with your gross sales revenue, then move through each section reporting accounts on the left and totals on the right. It tells a company the revenue gained and the expenses the contingent worker incurred in a month, quarter, or year. This financial statement draws a straight line to the viability of a company’s operations by presenting an organized view of earnings.

- Direct costs refer to expenses for a specific item, such as a product, service, or project.

- If you’re still struggling to track your business revenues and expenses in multiple ledgers, it may be time to move to accounting software.

- The gross margin computes the amount of money the company profits from the sales of its merchandise.

- In a true single-step income statement with no subtotals, line items for net revenues and costs and expenses are listed with a single total for Net income (loss).

- Like gross profit, operating income provides business owners with more detailed information on company profitability rather than focusing solely on net income.

- The header of your multi-step income statement conveys important information to readers.

Once the non-operating section is totaled, it is subtracted from or added to the income from operations to compute the net income for the period. If your operating income was a loss of $50 and your non-operating was a positive$100, your net income would still have been a positive $50. However, operating income can show the health of the business and when that item is decreasing or goes negative, it may raise red flags to stakeholders. Although the multi-step income statement comes with greater detail, it is not perfect.

What Businesses Use Multi-Step Income Statements?

Add the final number as a line item under the cost of goods sold and title it Gross Profit. You can also include taxes in this section, or if you’re looking to create EBIT (earnings before income taxes), you can create a separate section for taxes. Being able to see the performance in operating items and non-operating items is a benefit if your operating items performed well. There are two methods to calculate the Cost of Good Sold such as by using periodic method or perpetual method. In the above example, we follow the periodic format to compute the Cost of Goods Sold.

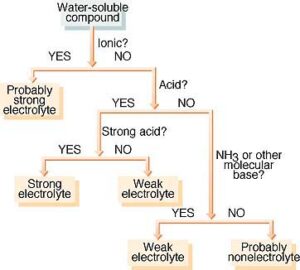

A multi-step income statement is more detailed and calculates the gross profit and operating income of the business using multiple calculations and an itemized breakdown. Single-step income statements aren’t very helpful for financial decisions that require more in-depth information about a business’s financial health than simply looking at its net income. When assessing a business’s financial performance, you’ll need more than just a single-step income statement. It is formatted with operating revenues and operating expenses separate from the non-operating revenues, non operating expenses, gains, and losses. With a multi-step income statement, income, expenses, gains, and losses are categorized into operating and non-operating to show a business’s financial performance. The non-operating expenses section tallies accounts that are not related to day-to-day business.

How restricted funding hinders nonprofits – St Pete Catalyst

How restricted funding hinders nonprofits.

Posted: Sat, 29 Jul 2023 17:25:26 GMT [source]

For example, our retailer isn’t in the business of receiving insurance proceeds. If a tree hit the building and the insurance company paid out a small settlement, the income would not be reported with total sales. It would be reported in the non-operating and other section because it doesn’t have anything to do with sales.

HOW TO PREPARE A MULTI-STEP INCOME STATEMENT

With the single-step layout, details are left out of the presentation and calculation of net income. The layout of the multi-step will allow the user to see the performance of the operating and non-operating components. For revenue to be recognized, a business needs to fulfill the obligations of a sale. Revenue is considered income when there has been an exchange of goods or services for money.

However, because of large sales commissions and delivery expenses, the owner(s) may realize only a very small amount of the gross margin as profit. In contrast to a multi-step income statement, the Dana Incorporated income statement is single-step mainly. The income statement doesn’t show Gross profit, separate and calculate Total Operating expenses, or calculate Total Operating income.

Company

Single-step income statements are simple to prepare and display net income as the focus metric. It is a way to show investors and management outside of the financial field, a snapshot of profit and loss. In a multi-step income statement, the total expenses and revenues generated over a period of time are reported separately as operating and non-operating heads.

This is simply the cash flow in from the sales of merchandise and the cash flow out from the purchase of that merchandise. This section not only helps measure the profitability of the core business activities, it also helps measure the health of the business. As discussed above, we saw how multi-step income statements are useful for investors and creditors to get a detailed insight into a company’s financial performance and its pros and cons. The attached example also helped us understand the different components used in such a statement.

The first step includes calculation of the gross profit, the second step calculates the operating income, and the third step helps us in computation of the net income. A multiple-step income statement presents two important subtotals before arriving at a company’s net income. For a company that sells goods (merchandise, products) the first subtotal is the amount of gross profit. The cost of goods sold is separated from the operating expenses and listed in the gross margin section.

- The classified income statement subdivides operating expenses into selling and administrative expenses.

- Since it is strikingly similar to the “cash from operations” section on the cash flow statement.

- If your operating income was a loss of $50 and your non-operating was a positive$100, your net income would still have been a positive $50.

- All revenues and gains are totaled at the top of the statement, while all expenses and losses are totaled at the bottom.

- Businesses may include a subtotal for Total expenses in a single-step income statement.

- On the other hand, the multi-step income statement requires three steps to complete, resulting in more detail about business operations, making it particularly valuable to investors and financial institutions.

A multi step income statement is more detailed than a simple single step income statement. It provides insights that financial statement users need when reading a profit and loss statement prepared using GAAP accounting standards. The gross margin computes the amount of money the company profits from the sales of its merchandise.

After review and approval by financial management, it can be distributed to authorized internal users. Even though the multiple-step income statement is more complex, many companies use it as it gives a more comprehensive insight to the user regarding the core operations of the business. It helps the user understand the performance of the primary business activities of the company in comparison to the non-primary activities of the business. The total operating expense of the business stands at $19,000, and thus to arrive at the operating income, we deduct the operating expense from the gross profit to arrive at a value of $131,000. Finally, to arrive at the net income, we add the operating and non-operating income to arrive at the value of $164,000.